The Marriage Penalty, the Federal Income Tax, and the Road to Genuine Liberty

A Call for Sweeping Reforms in America’s Tax Landscape

5 Top Stories from Around the World

Pexels/Denniz Futalan

House GOP Threaten Impeachment Of Attorney General Garland

Nigel Farage’s Coutts account closed as bank felt he did not ‘align with their values’

‘Dodgiest government in Australia’: Daniel Andrews went to election ‘based on lies’

Bank’s cashless branches leave customers empty-handed

‘Gone off a cliff’: Dems grapple with antisemitism ahead of Israeli president’s visit

Is Republican Leadership Truly Fighting for Marriage and Economic Liberty?

by Will Blesch, The Liberty Signal

In our previous two issues found here, and here, I argued that one of the greatest threats to individual liberty is poverty. One of the biggest factors that helps to prevent poverty is the family unit.

And the basic glue of the family unit is the relationship between a married couple. Marriage as an institution helps to mitigate poverty – and thus, it is an ally to liberty.

However, its very foundation is being eroded, not by societal trends, but by a punishing tax policy. In this issue, The Liberty Signal uncovers the damaging influence of Marriage Tax Penalties with a spotlight on the state of North Dakota.

This is a paradoxical situation where a state government, led by Republicans, is supposed to protect the best interest of their constituents, but instead are allowing the federal government to erode an institution proven to mitigate poverty. (And it’s not just North Dakota Republicans who are guilty of this.)

This examination sheds light on the disconnect between policy and reality, between intent and consequence, forcing us to ask – are elected Republicans in North Dakota and throughout the nation truly fighting for liberty as they claim?

What Are Marriage Taxes?

Marriage taxes, or the so-called “marriage penalty” and “marriage bonus,” are terms used to describe how the US federal tax system impacts married couples.

It is not an actual tax, but rather a discrepancy in the tax code that can result in some couples paying more taxes when they file jointly than they would if they were single.

Reflecting on our nation’s tax history, we have to journey back to the pre-1948 era. There was a time when the specter of a marriage penalty was virtually non-existent in our tax laws. Each taxpayer stood on their own, filing their taxes independently.

However, the landscape shifted significantly in 1948 with the advent of the joint return, a construct devised and set into motion by Congress. A seemingly simple change, but with far-reaching implications for our tax system.

States generally conform to the federal tax code in many respects, but they may also have their own adjustments and credits to lessen or eliminate any marriage penalty at the state level.

Arguments for the Marriage Tax

Advocates for the Marriage Tax draw upon three primary arguments. These are:

Promotion of Single-Income Households: One of the main arguments for the marriage tax is that it can favor couples where one partner earns significantly more than the other or is not employed. In these cases, a couple can often benefit from a “marriage bonus” where they pay less in taxes than they would if they were single.

Income Redistribution: It’s argued that the marriage tax, specifically the marriage penalty, can help redistribute income and make the tax system more progressive. Higher-income households are more likely to face a marriage penalty, which could contribute to overall income equality.

Historical Context and Tradition: The tax system was created in a different era, when single-income households were more common. This can be seen as an argument to maintain the current system.

Arguments Against the Marriage Tax

On the flip side, opposition against the Marriage Tax paints it as a policy replete with unjust penalties. This is a stance The Liberty Signal wholeheartedly agrees with and embraces.

For example:

Unfair Penalties: Marriage tax is unfair because it can penalize dual-income households. When two individuals with similar incomes marry, they can move into a higher tax bracket, paying more than they would if they were single.

Discourages Marriage: The marriage penalty could potentially discourage marriage among couples where both partners earn similar incomes.

Complexity: The US tax code is already complex, and the marriage tax can add another layer of complication. Critics argue that tax laws should be simplified, not made more intricate and potentially confusing.

Marriage Penalties in North Dakota

According to North Dakota Code 57-38-01.28, married couples filing joint returns in North Dakota can claim a credit of up to $300 per couple, which is adjusted annually.

This credit is designed to mitigate the marriage penalty, which refers to the higher taxes that some married couples pay compared to if they were filing as single individuals.

It’s indisputable that the state of North Dakota, under the stalwart control of the Republican Party, enjoys a unique position to enact robust changes in tax policy.

The idea of a mere $300 per couple credit as a remedy for the marriage tax is, quite frankly, a short-term band-aid on a long-term wound.

Such a measure fails to address the structural issues embedded within our tax code that disproportionately penalize dual-income married couples.

Let’s lay it out:

The Limitations of the Credit: A credit of up to $300, while helpful, is simply not enough to offset the financial burden imposed by marriage penalties. Especially when adjusted annually, this amount doesn’t keep pace with inflation or the increasing cost of living for most North Dakotan families.

A Call for Structural Tax Reform: The North Dakota state government, bolstered by the established Republican trifecta, possesses the political influence to initiate broader, more impactful tax reforms.

Rather than temporary credits, they should consider restructuring the tax brackets or revising how joint income is treated, ensuring married couples aren’t penalized for their commitment.

How can North Dakota Republicans seize this opportunity to incentivize marriage? There are a handful of promising strategies they could implement:

Expand the Tax Brackets: One primary cause of the marriage penalty lies in the discrepancy between individual and joint tax brackets.

By expanding the tax brackets for married filers, the state government could ensure that two individuals marrying and combining their incomes wouldn’t suddenly find themselves in a higher tax bracket.

Offer Substantial Tax Deductions: Beyond small tax credits, the North Dakota government could consider substantial tax deductions for married couples.

These deductions could take into account the number of dependents, housing costs, or education expenses, providing meaningful financial relief to families.

Promote Tax Credits for Childcare: Recognizing the financial strain of childcare, North Dakota could also implement robust tax credits for childcare costs.

By easing this financial burden, the state would be encouraging couples to start families, thus promoting marriage.

To these ends, Republicans in North Dakota should leverage their political influence to champion these tax reforms. It’s time to transform the rhetoric around marriage incentives into tangible policy changes.

This approach would not only demonstrate their commitment to supporting North Dakota families but also serve as a model for other states grappling with similar issues.

The True Solution

In The Liberty Signal’s opinion, even the suggestions for fixing the marriage penalty in North Dakota and elsewhere don’t go far enough.

The federal income tax, while enshrined in our legal system by the 16th Amendment, has been a source of contention from its inception. And not without reason.

To assert that it has no negative impacts on our economy, on individual prosperity, and on the sanctity of privacy is to ignore certain undeniable truths.

Inefficiencies and Economic Strains: The federal income tax, by its very design, diverts substantial resources away from productive economic use.

Compliance with the complex tax code requires vast amounts of time, money, and labor, effectively dampening productivity and innovation.

Impacts on Individual Wealth: High income tax rates can discourage labor force participation and savings, eroding individual wealth and stifling the economic growth of the country.

Government Misuse of Resources: As we’re reminded time and again, the federal government’s expenditures have soared into the trillions, often with questionable returns on investment.

This egregious misuse of taxpayers’ dollars calls into question the value and effectiveness of the federal income tax.

In the light of these realities, what if we entertained the idea of abolishing the federal income tax? The implications could be game-changing.

Greater Economic Freedom: By liberating individuals and businesses from the burden of federal income tax, we could potentially stimulate increased spending and investment.

This would not only bolster individual financial health, but also catalyze broader economic growth.

Promotion of Marriage and Family Growth: Without the specter of marriage penalties, more couples might choose to tie the knot. By turning the marriage penalty into a marriage incentive, we could promote family growth and stability.

Reduction of Poverty: More money in the hands of the people means more capacity to invest in education, business, and life-enhancing opportunities. This could be an effective tool in reducing poverty levels across the country.

So, how could Republicans and independents on Capitol Hill bring about such a monumental shift?

Advocate for a Fair Tax or a Flat Tax: Replace the federal income tax with a consumption-based tax or a flat tax. This could not only streamline the tax system but also ensure everyone pays their fair share.

Promote Tax Decentralization: Instead of a one-size-fits-all federal tax, advocate for states to establish their tax systems. This could lead to more responsive, localized tax policies.

Introduce Legislation: Proactively introduce bills aimed at repealing the 16th Amendment, dismantling the federal income tax while offering viable alternatives.

The task is formidable, but the potential benefits – for individuals, for families, and for our economy as a whole – make it a challenge worth undertaking.

What if Democrats Stand in the Way?

In our mission to convince Democrats about the potential advantages of abolishing the federal income tax, it’s crucial to articulate our arguments in a manner that aligns with their core values.

We’re not striving to subvert their principles, but rather highlight how this policy change can further their objectives.

Here’s how to make our case:

Championing Equality: Emphasize that the current tax system, with its countless loopholes and complexities, is disproportionately benefiting the wealthy.

By scrapping the federal income tax and potentially replacing it with a flat or consumption-based tax, we can promote fairness and equality – a mission that deeply resonates with Democrats.

Boosting the Economy: Stress on the concept of greater financial fluidity for individuals and corporations, which would stimulate spending, investments, and economic growth.

Make it clear that this policy shift is about creating a thriving economy for all Americans – more jobs and opportunities is a universally appealing prospect.

Reducing Poverty: This is not just a policy reform; it’s a lifeline for those at the lower end of the income spectrum.

Highlight how eliminating the federal income tax would put more money into the hands of low-income families, helping them meet essential needs and build a secure future.

Promoting Environmental Sustainability: Present the idea of a consumption-based tax as an opportunity for environmental stewardship.

Explain how higher taxes on non-essential and environmentally harmful goods could nudge consumers toward greener choices.

Enhancing Government Efficiency: Underscore the simplification and efficiency that would follow the abolition of the federal income tax. Reinforce the notion that a leaner, more efficient government can better serve its people.

In essence, it’s about positioning the tax reform as an initiative that embodies shared values and serves mutual goals. By bridging the partisan divide and focusing on the shared objective of a better America, we can build a compelling case for change.

Summary

Marriage and economic well-being are critical foundations for our society, and it is disheartening to observe how these pillars are undermined by tax policies that disincentivize commitment and penalize dual-income households.

Through our deep dive into North Dakota’s tax policy, we’ve explored the adverse implications of the marriage tax and suggested potential reformations that could support married couples.

However, the more profound issue at hand is the federal income tax itself, which creates economic strains and inefficiencies while impinging on individual wealth.

Imagine a future where this tax is abolished, a future of greater economic freedom, promotion of marriage and family growth, and a significant reduction of poverty.

Now is the time to pressure our elected Republican officials to fight not just for marriage but for the economic well-being of all Americans.

- Reach out to your local representatives and senators and demand that they champion these causes.

- Remind them that they are elected to serve their constituents’ best interests, uphold the family unit’s sanctity, and protect and promote economic freedom.

- Encourage your networks to do the same because the more voices we have calling for change, the more powerful our message becomes.

Together, we can push for a transformative policy shift that genuinely supports all Americans’ prosperity.

Libertarian Commentary

The Libertarian and Conservative Case for the Abolition of Marriage Laws (Part 2) – by Peter S. Rieth, first published August 3, 2011

The Right and Marriage

Nietzsche noted in one or another of his writings that as cultures decline, so too the number of laws meant to preserve them seem to multiply.

Thus things that at one time did not seem to need legal mandates are being proposes as new laws by conservatives.

There is perhaps no more direct example of this than the proposals to create a Constitutional Amendment in the United States that defines marriage as being between a man and a woman.

One almost wants to consider whether, at this rate, we shall not next be amending the constitution to say that “a father is understood to be a man” or that “dogs are not cats.”

As moral relativism and multiculturalism progress in or schools and in our culture, the notion that words can be used to signify things, and that language is a tool for communication rather than confusion becomes out of date and old fashioned.

In light of this, conservatives often feel that they must rescue common sense by using the full force of the state apparatus to do so.

The most extreme example of this was William F Buckley’s call to tolerate a totalitarian bureaucracy in the United States as a necessary price to pay in order to halt communism (predictably, communism is long halted; the bureaucracy remains and grows).

The impulse to use the state as a means to coerce virtue, or even the recognition of common sense, is a powerful temptation – and is perhaps a particularly fatal temptation for conservatives who should know better.

(to be continued…)

Read more at Lewrockwell.com

A Recession Could Be Coming: Make Money Or Lose Everything

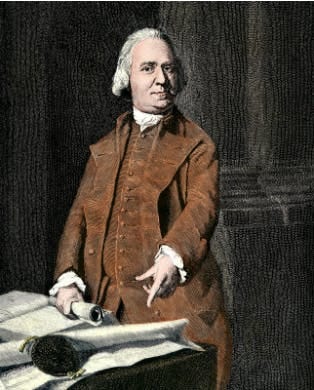

Featured Freedom Fighter: Samuel Adams

America’s history is filled with the passion and dedication of men and women who have worked tirelessly to uphold the values of liberty and democracy.

One such individual is Samuel Adams, a founding father whose determination and wisdom helped shape the nation we know and love today.

Born in Boston on September 27, 1722, Samuel Adams grew up in a deeply religious and politically active family. He graduated from Harvard College in 1740 and went on to become a prominent figure in colonial politics.

As a staunch advocate for American liberty, Adams played a key role in the events leading up to the American Revolution.

He was a driving force behind the creation of the Sons of Liberty, a secret organization of patriots that opposed British taxation and infringements on colonial rights.

Through his powerful writings and speeches, he inspired his fellow colonists to take a stand against oppressive policies. His leadership proved instrumental in organizing the Boston Tea Party, an event that ultimately pushed the American colonies towards independence.

Elected to the Continental Congress in 1774, Adams worked alongside other founding fathers to draft the Declaration of Independence and later, the Articles of Confederation. He was also a tireless advocate for the Bill of Rights, which safeguards individual liberties to this day.

Samuel Adams’ unwavering commitment to the cause of liberty serves as an example for us all. It is our duty to honor the sacrifices made by Adams and other patriots by continuing to defend the freedoms they fought so hard to secure.

As you go about your daily life, we encourage you to remember the passion and perseverance of Sam Adams.

Let his story inspire you to remain steadfast in the fight for liberty and Western ideals, ensuring that the spirit of the American republic and freedom remains strong for generations to come.

Delicious, Easy-To-Make Smoothies For Rapid Weight Loss, Increased Energy, & Incredible Health!

ENDING SOON! – GET AN INSTANT $10 OFF!

JUDEO CHRISTIAN SECTION: Divine Insight

Ecclesiastes 4:9-10 (NASB)

9 Two are better than one because they have a good return for their labor;

10 for if either of them falls, the one will lift up his companion. But woe to the one who falls when there is not another to lift him up!

The well-known Jewish sage, Rashi explains of verse 9 that, “Two are better. In all aspects. Therefore, a person should acquire for himself a companion and marry a woman, for they have a greater return in their labor.”

In his essay on this subject, Christian commentator Paul J. Bucknell notes that:

“Behind the family concept, is the “two are one” concept of marriage. The husband and wife are two distinct people with their own wills and desires, but in marriage a special synergy takes place that creates more than what they would each have by themselves.”

SAVE THE COUNTRY SECTION

(Actionable Tips Toward a More Free America)

As always, we’re super excited to share some awesome tips with you in every issue of The Liberty Signal. Our goal is to give you quick and actionable steps you can start doing right now to make a real difference in your life.

With that in mind, here are 9 actionable tips that married couples can consider to potentially improve their financial status:

- Understand Your State’s Tax Laws: Different states have different tax laws, with some imposing a “marriage penalty.” Make sure to understand how your state’s tax laws may affect you and your spouse.

- Consider Filing Taxes Separately: Depending on your state’s tax laws and your individual circumstances, you may find that filing taxes separately could help avoid or lessen a potential marriage penalty.

- Maximize Deductions and Credits: Ensure to utilize all available deductions and credits. This may require filing jointly, as some deductions and credits are not available or are reduced if you file separately. Consult a tax professional to understand the best approach for your situation.

- Home Ownership: Tax advantages such as deductions for mortgage interest and property taxes can be available to homeowners. Research how this could benefit you in your particular state and consider this aspect when deciding whether to rent or buy.

- Consider Income Averaging: If you and your spouse have significantly different incomes, filing jointly could potentially reduce your overall tax liability due to the way tax brackets work.

- Get Involved in Political Activism Together: If you and your spouse share political beliefs, consider getting involved in political activism together. This can strengthen your bond and potentially lead to opportunities for financial improvement.

- Engage in Charitable Activities: Making charitable contributions can potentially provide tax deductions. Consider getting involved in charities that align with your shared political and spiritual beliefs.

- Financial Planning: Consider working with a financial advisor who can help you navigate your state’s tax laws and provide personalized advice. This can help optimize your finances and minimize tax liabilities.

- Shared Political and Spiritual Beliefs: Marrying someone who shares your political and spiritual beliefs can foster a strong, harmonious relationship, which can indirectly improve your financial status.Shared values and goals can lead to unified financial decisions and planning, leading to long-term financial stability.

Discover Conservative America’s Number 1 Check: The TRB Black Check

Final Word

Know likeminded people who want to learn, grow, and fight for principles of liberty? Recommend The Liberty Signal to them. They can sign up today — it’s free!

• Have a tip or story idea you want to share? An effective strategy or tactic for spreading the message of Liberty? Email us — I’d love to hear from you! (support@thelibertysignal.com)

• Have thoughts about this issue of The Liberty Signal? Write us and let us know. (support@thelibertysignal.com)

We look forward to seeing you again in the next issue.

Yours in Liberty,

Will Blesch, The Liberty Signal